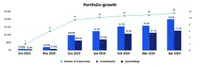

Our job is to bring you solutions that go beyond the expected. In just over our first six months as a Fund Finance team at EverBank, we have closed 28 transactions with 21 distinct sponsors, representing $2.0 billion in loan commitments and $1.3 billion in outstandings. We started last fall with subscription facility participations to validate our operational capabilities, but have now meaningfully expanded our offerings in furtherance of our long-term strategy to become a leading provider of bespoke financing solutions for the greater private capital industry.

Of our 28 closed transactions, five are true NAV deals, spread across multiple underlying asset classes including secondaries, buyout and alternative private credit. We have closed four customized hybrid transactions, including a structure in the end of fund life context combining available recallable capital and a healthy portfolio. We have closed several unique bilateral subscription facilities, including in the single asset continuation fund context where the investor base consisted disproportionately of secondaries funds. We have also provided a first out, back leverage credit facility to an elite private credit fund, supporting one of the private credit fund’s NAV facilities. Our portfolio includes a healthy mix of subscription facilities, and we have closed multiple all high net worth investor pool transactions. 11 of our closed transactions are bilateral; the rest are participations with many of the market’s most experienced leads.

The EverBank Fund Finance team in Miami at the Global Fund Finance Symposium.

Our operational and infrastructure build out is ahead of schedule. We are extremely pleased with the talent and growth of our team. Our headcount now stands at 18 full time Fund Finance professionals, including dedicated operations and portfolio management personnel. Many of the fund finance industry’s leading bankers have joined us, bringing a wealth of experience, relationships and execution capability.

Our team is pleased to share that Josh Kinsey, a long time EverBank Fund Finance banker, has transitioned to the role of Senior Credit Officer for Fund Finance, providing a deep understanding of our industry’s nuances within our credit and underwriting function. Thanks to the great work of Gabby Buckner, we have completed an upgrade to our loan operations system, validated our funding capabilities in virtually all the primarily currencies, finalized all of our initial policy requirements, and are in the early stages of onboarding a fund finance portfolio management software tool.

Over the coming two quarters, we have big plans to expand our service offerings and capabilities for our clients. Our pipeline is full of potentially unique transactions, including liquidity facilities for collateralized fund obligations and multiple partnered transactions with private credit firms to manage to an overall blended cost of funds that is attractive for the borrower. Our syndication and distribution desk is under development and we expect to syndicate opportunities as early as May. We are working the new product approval process to add management fee lines as a separate, distinct product offering. Our treasury and information technology teams are beta testing an entirely new treasury management system, which aims to offer best-in-class treasury management for alternative asset managers. We hope to make that offering available early next year. And we are in discussions with several prominent Fund Finance bankers about joining our platform. So a lot of both work and exciting initiatives on the horizon.

Head of Asset-Backed Finance

Jeff Johnston

Head of Fund Finance

Mike Mascia

Tooltip

Tooltip content