With the end of the first quarter being punctuated by market volatility and accelerating uncertainty, we wanted to update our stakeholders on EverBank’s positioning and current approach to the Fund Finance markets. Like everyone, we are watching the tariff policies and the corresponding market impacts in real time, but our fundamental 2025 business plan remains unchanged. While we are certainly increasing due diligence on cross border businesses underpinning our transactions and being thoughtful about geographic and industry concentration limits in our structures, Fund Finance at EverBank is fully open for business. In fact, of the half-dozen transactions we closed in the last three to four weeks, all of them were consummated on the terms we had committed to with our clients prior to the onset of this round of volatility. And our pipeline forecasts another 8-10 or so closings in the next month that we will be pleased to see reach the finish line. So, while we are closely monitoring the macro, we are staying the course and continuing to look for new lending opportunities to support our clients.

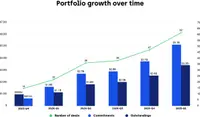

Our Fund Finance portfolio continued to expand during the first quarter. We now stand at 62 distinct facilities with 44 sponsors, representing $5.1 billion in loan commitments and $3.3 billion in outstandings. Like for many in the market, January and February were somewhat muted, as transaction timelines stretched with softness in underlying fund deployment. March, however, more than held serve and ended up being one of our biggest months yet in terms of both closings and fundings.

Despite the choppy environment, our pipeline looks very healthy, and we are seeing a relatively robust inflow of bankable transactions at the top of the funnel. Our portfolio is well-distributed across the Fund Finance product segments, with a slight lean toward subscription facilities but with a healthy mix of NAV loans and hybrids. Our familiarity with the secondaries space has enabled us to be helpful for clients in the continuation vehicle (CV) context, and we have now closed a number of subscription facilities based on secondaries funds’ capital commitments to CVs. Similarly, we have participated in a number of collateralized fund obligations and rated note feeder constructs, both in their liquidity facilities and in the rated tranches. We see these structures as a meaningful area for further growth. Equity commitment facilities backed by a fund’s uncalled capital (in excess of the related subscription facility outstandings and other debt) is another customized structure where we have a number of matters in progress.

The Fund Finance event calendar has been active, and we have been trying to attend and contribute as much as we can. Jennifer Choi and the Institutional Limited Partners Association (ILPA) hosted a very constructive round table session on April 7 in New York that brought together institutional investors and the Fund Finance lending community to discuss NAV lending and its use cases. Interestingly, we think the feeling in the fund sponsor (GP) community that institutional investors strongly oppose NAV loans is misguided. Rather, we think institutional investors fully understand that certain NAV loan use cases can be accretive and beneficial for both GPs and limited partners (LPs). But the LP community (perhaps tied to the recurring media accounts) has significant skepticism around NAV loans being used for the purpose of funding investor distributions, particularly if doing so creates additional recallable capital. That use case is so infrequent (and when actually done in practice often LP-driven) that it is unfortunate that it clouds the narrative. We heard the ILPA community request further transparency and communication around NAV loans from the GPs, with a preference for prior disclosure and use case explanations to LPACs.

We at EverBank fully support and encourage dialogue between GPs and LPs about all financings at the fund level. Our belief is that, by far, the vast majority of Fund Finance facilities are entirely appropriate, add liquidity, enhance returns, and further the alignment of interests between LPs and GPs. More robust disclosure and dialogue will help the LP community understand that the GP community is using Fund Finance in a very responsible manner, and thereby increase trust and ultimately support the industry’s continued growth.

We have also been busy on the panel and speaking circuit. There is only one person in the Fund Finance industry that could tell Tom Brady that their son’s name is Brady Thomas. The EverBank team had a blast watching Jeff Johnston interview Tom at the Fund Finance Association (FFA) Symposium in February. You do not get to see the GOAT chuck a football across the ballroom very often and it was a highlight of this year’s conference. We at EverBank see every day how much Jeff gives of himself to the FFA and the Miami event each year. Well done and thank you.

Jeff Johnston interviews Tom Brady at the Fund Finance Association (FFA) Symposium in February.

Josh Kinsey also spoke at the FFA Symposium on the “Trends and Innovations in Secondaries NAV Lending” panel. Josh is developing quite an expertise in all aspects of the secondaries market and we were pleased to have him represent EverBank. Storey Whalen moderated a panel titled “The Intersectionality of Private Credit and Fund Finance” at a Women in Fund Finance Lunch & Learn in March in Boston. The substance of the panel covered the ways in which traditional Fund Finance products have supported the private credit sector to date as well as the opportunities and gaps in the market. This aligns perfectly with one of our key market segments at EverBank: we believe the private credit segment is poised for significant expansion far beyond its direct lending roots and we plan to be a leader in supporting that growth.

Congrats to Lissa Broome and the UNC Law Center for Banking and Finance for hosting another excellent Banking Institute on March 27 and 28 in Charlotte, North Carolina. Lissa is the Burton Craige Distinguished Professor of Law at UNC and the Director of the Center for Banking and Finance. EverBank was pleased to host a welcome dinner and participate in the panel session on “The Rise of Private Credit and its Intersection with Banking Markets”. Thanks to our clients and friends Pramit Sheth of Dawson, Brad Boland of Huntington Bank, Robert Cammilleri of Barings and Justin Reimer of Golub Capital for joining us on the panel.

And finally, thank you to all of our clients who joined us for EverBank's Client Event at THE PLAYERS Championship.

.jpg&w=200&h=200&q=&fit=contain&fm=webp)

The 17th "Island Green" at TPC Sawgrass.

Long time Fund Finance banker Nick Strott joined EverBank earlier in April as a Managing Director. Nick has well over a decade of Fund Finance experience with some of the best shops in the market and we have big expectations for what he will bring to our clients and platform. Welcome Nick! We were also thrilled to recognize the outstanding contributions of a number of our colleagues across the greater Asset-Backed Finance team with promotions in this year’s cycle.

Please join me in congratulating:

Gabby Buckner, Managing Director

Marty O’Brien, Managing Director

Ryan Burke, Director

Ninh Lam, Vice President

Matt Mildenberg, Vice President

Bill Kaminski, Vice President

Andrew Williamson, Associate

As we continue to grow, we are hiring for multiple positions and have openings across our platform from the Analyst level all the way up through Managing Director. If you are interested in being part of the EverBank story, we would love to talk. Thanks very much for your support.

Head of Asset-Backed Finance

Jeff Johnston

Head of Fund Finance

Mike Mascia

Tooltip

Tooltip content